How to get used car loan hdfc ?

used car loan hdfc is for customers who are having a good credit history and if you are looking to buy a used car or Refinance your existing vehicle, then you should consider getting a loan from HDFC BANK. Not only does this option help you save some money, but it also helps you get into the car market much sooner than you might otherwise be able to do. You won’t have any problems getting approved for a loan because you can provide necessary documents that your income is stable and reliable.

This article will explain everything you need to know about getting a used car HDFC, so keep reading in order to find out more!

What is an HDFC used car loan?

A used car loan is a type of loan that you take out to buy a used car or refinance your existing vehicle or get top-up loan on that vehicle. This allows you to acquire a car at a fraction of the price that new cars go for. Used cars come with a lot of advantages, including their lower price tag, which means that you won’t have to pay as much for it.

This makes used car loans a great option for people with a low budget, who don’t have the time or the resources to look around for the best deal. Used car loans from HDFC are also very convenient, as they allow you to take a loan at a low interest rate that you repay over an extended period of time. This means that you won’t have to pay as much in total as you would have to pay for a new car loan.

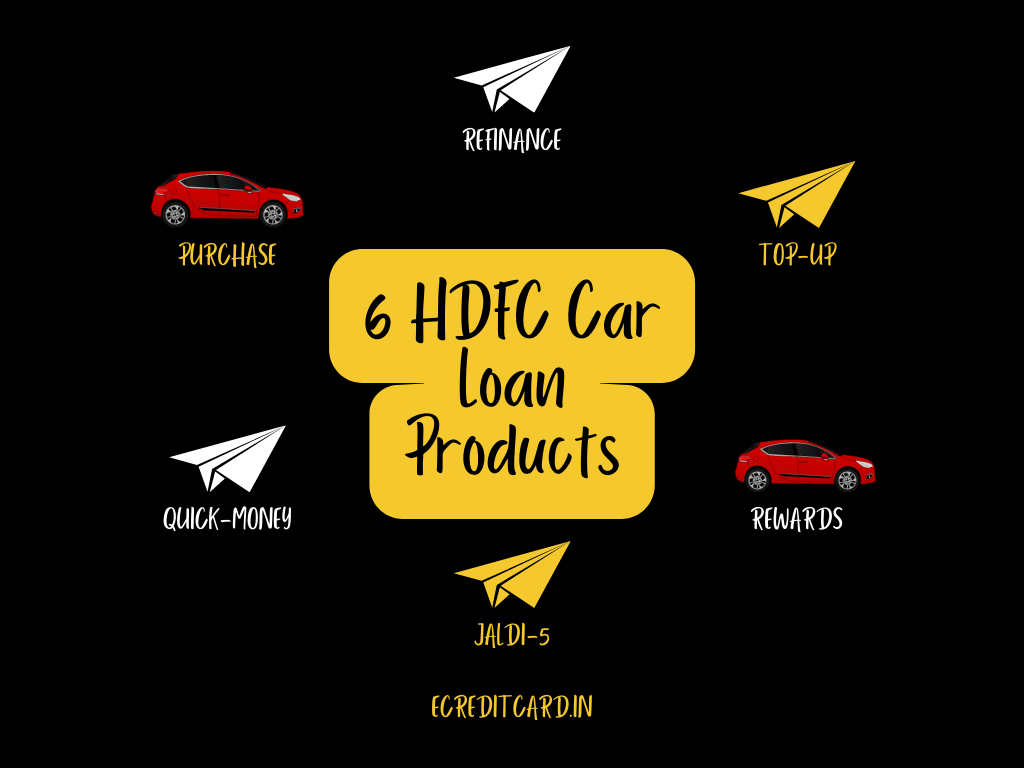

Types of used car loans available in Hdfc Bank

Used car loans are available to Indian borrowers in different forms, including Refinance, Top-up, Rewards, Jaldi-5 and Quickmoney.

Refinance or Used car loan Hdfc

Refinance, used car loan or loan against car is asset based loan providing by Major Banks for customers who are having a car with good condition, this loans are processed quickly and easily with attractive rate of interest. Hdfc bank provides best rates, processing fee and many more. Loan Amount is provided based on vehicle present valuation upto 100% funding

Documents Required: KYC, 6 Months Bank statement, RC Copy, 3months payslip(for salaried) latest 2 year ITR(for Self Employed) Car insurance, 1 Photograph

Car loan topup

A top-up is usually offered to existing hdfc bank customers who are having a clear repayment for the minimum tenure of 12 months without any dues or cheque bounces, customers can avail 80% loan amount on the paid emi’s

Documents Required: KYC, 6 Months Bank statement, RC Copy, 3months payslip(for salaried) latest 2 year ITR(for Self Employed) Car insurance, 1 Photograph

Rewards

Customers having paid emi’s for more than 12 months from loan sanctioned date without any cheque bounces are eligible for Rewards program on their vehicle. This is a Pre-approved offer with fixed loan amount and required minimum documentation

Documents Required: KYC, 6 Months Bank statement, RC Copy, Car insurance, 1 Photograph, this process will take approximately 3-4 Working days to complete

Note : Accident vehicles are not eligible for any type of loan

Jaldi-5

This Pre-Approved offer comes with fixed loan amount, Rate of interest and processing fees, just by providing basic Kyc, 6 Months Bank statement, and post- dated cheques in the name of “Hdfc Bank Ltd A/C Auto Loan”, Customers can avail this offer with low fixed rate of interest. This offer doesn’t require any house verification or office verification and vehicle valuation, Loan Amount will be credited in a day after submitting required documents

Quick-Money

A 10 Seconds Disbursement offer only available for Hdfc Bank Account holders having loan running in Hdfc bank ltd, Zero Documentation, Low processing fee, 0.50% stamp duty, fixed interest. This Quick-Money offer doesn’t required any documentation, verification or valuation. Customers can avail this loan through Net Banking, Phonebanking or just by clicking the link below we can check your eligibility. Loan amount will be credited in 10 seconds

Used Car Purchase Hdfc

You can purchase any used car from trusted dealers, friends or relatives, Hdfc bank is here to provide easy used car purchase loan for you with minimal documents, fast processing and low interest.

- Rate : Interest Rates are minimum 14.75% to Maximum 16 % for preapproved customers rate may be vary depending on the offer

- Documentation : Pan Card, Aadhar card, Rc, Bank statement, Payslip for (Salaried), ITRS (Self-Employed)

- Tenure: 36Months to 60 Months

- Time : processing take varies from product to product

Conclusion

In summary, used car loans from HDFC are one of the best ways to get a low-cost car with a low monthly payment. These loans come with very low interest rates and even the possibility of extending the loan terms. They are safe and are a great option for people with a low income.

1 comment so far